Hourly pay cut calculator

The state tax year is also 12 months but it differs from state to state. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Check Target Hourly Rate Calculator Check

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

. Use this calculator to see how inflation will change your pay in real terms. Your average tax rate is. Some people define a month as 4 weeks.

Federal Salary Paycheck Calculator. Suppose a person has an annual salary of 45000 and works 20 hours per week and 52 weeks in a year. Proactive money-saving measures require time and attention but can trim worthy savings from household budgets.

For monthly salary this calculator takes the yearly salary and divides it by 12 months. How do I calculate hourly rate. This calculator does not calculate monthly salary based on a 4 week month.

2022 Hourly Wage Conversion Calculator. Hourly salary X. Next divide this number from the.

Some states follow the federal tax. Hourly rate Annual salary Hours worked per week Weeks per year Example. However they sometimes are the only choice an employer can make during difficult economic periods.

Save a copy to remember your changes. There are two options in case you have two different. Some people define a month as 4 weeks.

That means that your net pay will be 40568 per year or 3381 per month. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. For example for 5 hours a month at time and a half enter 5 15. Enter the number of hours and the rate at which you will get paid.

Calculate your pay cut easily. Pay cuts arent ideal. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

This public calc has been shared with the community. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Input the date of you last pay rise when your current pay was set and find out where your current salary has.

Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the.

Hourly Rate Calculator The Filmmaker S Production Bible Filmmaking Bible Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

What You Need To Know About An 8 Hour Workday Calculators

A Free Calculator To Convert A Salary Between Its Hourly Biweekly Monthly And Annual Amounts Adjustments Are Salary Calculator Salary Financial Calculators

Salary To Hourly Calculator

Jun Jewelry Making Business Sewing Business Craft Business

Debt Tracker Printable Saving Tracker Debt Tracker Savings Etsy In 2022 Credit Card Tracker Diy Money Paying Off Credit Cards

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

How To Work Out Time And A Half Hourly Pay Rate From The Normal Pay Rate With No Calculator Youtube

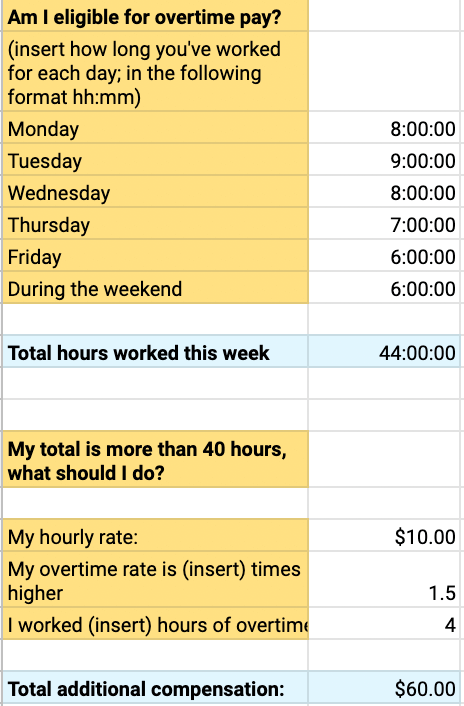

Overtime Calculator

How To Calculate Your Hourly Rate 7 Step Solopreneur Guide

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Are You Ready To Calculate Your Real Hourly Wage Google Sheet

Hourly To Salary Calculator Convert Your Wages Indeed Com

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Pay Cut Calculator Instacalc Online Calculator

Free Pay Raise And Pay Cut Calculator Timesheets Com